Business

LCCI, KPMG Task Govt On VAT Increase

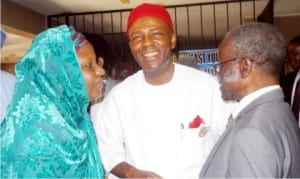

L-R: Permanent Secretary, Federal Ministry of Science and Technology, Dr Lawal Habiba; Minister of Science and Technology, Dr Ogbonnaya Onu and the President, Nigeria Academy of Engineering (NAE), Prof. Raifu Salawu, during a courtesy visit of NAE’s delegation to the Minister in Abuja, yesterday

The Lagos Chamber of Commerce and Industry (LCCI) yesterday said there was a need to boost the nation’s internally generated revenue through higher consumption tax.

The Director-General of LCCI, Mr Muda Yusuf, told newsmen in Lagos that emphasis on tax revenue generation should shift to consumption tax.

He suggested that tax should shift from taxes on investors and entrepreneurs to taxing consumption of some products and services.

Yusuf spoke against the backdrop of the recommendation of the IMF Managing Director, Christine Lagarde, that Nigeria should increase its VAT.

According to him, the ratio of tax to GDP in Nigeria is one of the lowest in the world.

Yusuf said that imposition of VAT in Nigeria should be in favour of the poor by exempting some goods consumed by the poor.

“This is necessary so that they do not compound the poverty rate challenges in the country”.

The LCCI chief also called for more efficient tax administration in the country by plugging all loopholes for tax evasion.

“Presently, those paying tax are in the formal sector. There has to be a framework to ensure that those in the informal sector also pay tax to boost tax revenue.”

Mr Ayo Salami, a tax expert at KPMG, also told newsmen that the suggestion by IMF was in order since VAT increase was enshrined in the National Tax Policy framework.

Salami, a Partner of Tax, Regulatory and People Services at KPMG, said that the policy laid more emphasis on indirect taxation.

According to the tax expert, less emphasis should be on direct taxation because of low cost of collection and evasion.

“The question is that if VAT rate is increased, how much the government will be willing to give back via reduction in direct tax that is corporate tax and personal income tax.

“This is to ensure that the populace is not worse off even if the government benefits in terms of tax revenue collection.”

Business

Expert Tasks Government On Civil Maritime Security Unit

Business

Bayelsa Recommits To Infrastructure, Sectoral Dev … Rakes In N227.185b From IGR

Business

NDYC Seeks NDDC Commercialisation … Uncompleted Projects Completion

-

Business1 day ago

Oil Production Resumption: Ogoni Youths Seek Inclusion In FG’s Plans

-

News1 day ago

News1 day agoSenate Reshuffles Committees, Appoints New Chairmen For Dev Commissions

-

Nation1 day ago

Nation1 day agoBizman Alleges Threat To Life …Seeks Police , Govt’s Intervention

-

Rivers1 day ago

NOSDRA D-G Disburses N150m To 300 Farmers In Rivers

-

Niger Delta1 day ago

Niger Delta1 day agoOgoni Postgraduate Forum Tasks HYPREP On Scholarship Scheme

-

Business1 day ago

NCDMB Assures Greater Local Industry Participation In Oil, Gas Projects

-

News1 day ago

News1 day agoNigeria Strengthens Economic Ties With Germany To Boost Investment, Jobs

-

Featured1 day ago

Featured1 day agoFubara Flags Off Upgrading Of 135 Primary Healthcare Facilities In Rivers