News

‘Paris, London Clubs Loan Refund: Our story’

The Nigerian Governors’ Forum, NGF, last night, cleared the air on claims that a large chunk of cash meant for the refund to states from the Paris and London clubs had been diverted and shared by some unnamed governors in the country.

The NGF made it clear that since the current leadership of the body stepped into the matter, which started as early as 2005, nothing illegal had been committed in the entire process leading to the final disbursement to states of the first tranche of Paris-London Clubs repayment of the excess deductions from states’ coffers and the refund of their loans.

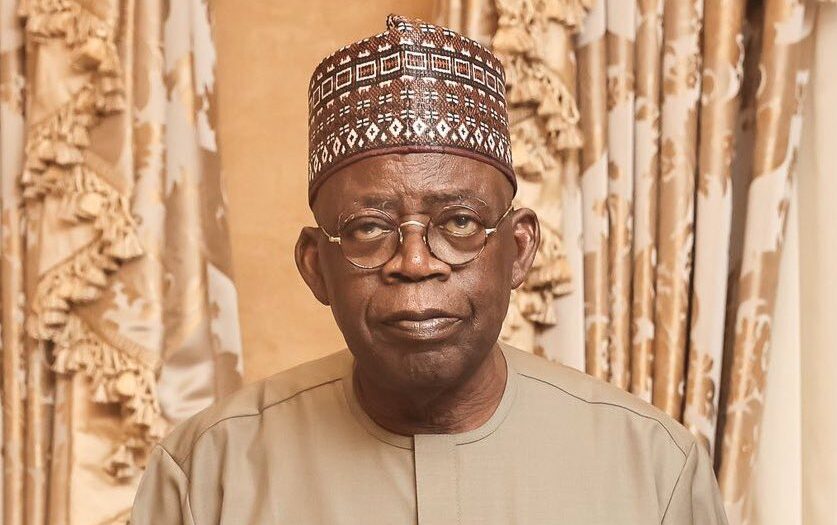

President Muhammadu Buhari being welcomed by Governor Shettima of Borno State (r) as the Nigeria Governors Forum hold a special session for President during the National Economics Council meeting at the State House, Abuja.

The NGF said it was to the credit of the current set of governors that President Muhammadu Buhari accepted their proposal and ordered the release of the refunds, which had been hanging over the years, to their states to pay arrears of salaries. The forum stated that President Buhari would not have authorised the release of the second tranche of the refunds to states if there had been any case of corruption or unpatriotic practice associated with the disbursement of the first tranche by the NGF.

The NGF said: “It is true that there were conditions attached to the disbursements but these arose from the collective and voluntary resolution of the governors and not any draconian order from any quarters. “It shows that the governors themselves are responsible, sensitive and compassionate enough to understand the plight of Nigerians that they govern and therefore work in the interest of their people.

“It is important to state that in approving the repayment, due process was diligently followed and each and every approving authority, including the Federal Ministry of Finance, the Office of the Accountant-General of the Federation, the Central Bank of Nigeria and the Office of the Auditor General of the Federation as well as the National Assembly were duly informed from the beginning to the end of all the transactions.

“Nothing illegal was done and no money was paid into the personal account of any governor, legislator or top officials at any of the levels and arms of government in the country.’’

The NGF also clear the air on the involvement of many consultant in the process of determining what accrues to each state and what was due to them in the end, pointing out that there was no attempt whatsoever to cheat. “Indeed, a number of consultants were saddled with the task of verifying the amounts due to each of the states.

These consultants were recruited by the respective states but were eventually collapsed into a consortium of only a few, even though the others who did not make it to the final group were reimbursed according to their input.

“It may interest the readers that many more consultants throughout the country are still insisting that they did work on this same Paris-London Clubs repayments since a decade ago and that they are entitled to some compensation as well.

“Many of them had actually and verifiably done some work in the past and negotiated a fee of between 10 per cent and 30 per cent, with the different states that engaged them.

It was therefore immoral and impossible to deny each their due, provided their input is verified and justified “It should be noted that if the Federal Government under the watch of President Buhari had found anything corrupt, illegal and unpatriotic about the payment or the utilization of the first tranche of the Paris-London Clubs Fund repayment to states, it would not have approved the payment of the second tranche to the states.

“After all, we all know the unimpeachable level of commitment of President Muhammadu Buhari on the issues of transparency and accountability. In any case, those writing those fictitious reports on the payment have also acknowledged that the president had insisted on the verification of the process of utilization of the first tranche before the second is approved for release. “Note also most importantly at this juncture that every decision that was taken in respect of all the transactions was with the full consent and blessing of the 36 governors. “We therefore find the insinuation in the media that monies went into the private accounts of seven unidentified governors as not only preposterous but mischievous.

This is more so because none of the reports was able to identify a single governor, not to talk of seven.

“The Economic and Financial Crimes Commission, EFCC, itself had issued a release exculpating all the governors, saying it was investigating the matter further. But instead of allowing the EFCC to conclude its investigations, a particular section of the media resorted to this unsavoury falsehood which puts the media and its practitioners in bad light.

“Finally, this forum wishes to appeal to the media to ply their trade responsibly.

We know that in a democracy comments are free, but facts must be sacred too,” the NGF pleaded.

News

Tinubu Orders Security Chiefs To Restore Peace In Plateau, Benue, Borno

President Bola Tinubu has ordered a security outreach to the hotbeds of recent killings in Plateau, Benue and Borno States, to restore peace to areas wracked by mass killings and bomb attacks.

National Security Adviser, Nuhu Ribadu, disclosed this to State House correspondents after a four-hour security briefing with the President at the Aso Rock Villa, Abuja on Wednesday.

“We listened and we took instructions from him. We got new directives…to go meet with the political authorities there,” Ribadu told reporters, adding that Tinubu directed them to engage state-level authorities in the worst-hit regions.

Director-General, National Intelligence Agency, Mohammed Mohammed; Chief Defence Intelligence of the Nigerian Army, Gen. Emmanuel Undianeye; Director-General, Department of State Services, Oluwatosin Ajayi and Chief of Staff to the President, Femi Gbajabiamila, appeared for the briefing.

The Tide’s source reports that in Plateau State, inter-communal violence between predominantly Christian farmers and nomadic herders spiralled into gory slaughter when gunmen stormed Zikke village in Bassa Local Government early on April 14, killing at least 51 people and razing homes in a single night.

In Benue, at least 56 people were killed in Logo and Gbagir after twin assaults blamed on armed herders.

Meanwhile, in Borno State, eight passengers perished and scores were injured when an improvised explosive device ripped through a bus on the Damboa–Maiduguri highway on April 12.

Ribadu explained that after an extensive briefing, intelligence chiefs received fresh instructions to restore peace, security and stability across Nigeria.

“In particular, Tinubu had ordered immediate outreach to the political authorities in Plateau, Benue and Borno States, and the defence team had gone round those States to carry out his directives and report back.

“We gave him an update on what has been the case and what is going on, and even when he was out there, before coming back, he was constantly in touch. He was giving directives. He was following developments, and we, in charge of the security, got the opportunity today to come and brief him properly for hours. And it was exhaustive.

“We listened and we took instructions from him. We got new directives. The fact is, Mr. President is insisting and working so hard to ensure that we have peace, security and stability in our country. We gave him an update on what is going on, and we also assured him that work is ongoing and continues.

“We also carried out his instructions. We went round, the chiefs were all out where we had these incidents of insecurity in Plateau State, Benue State, even Borno, these particular three states, and we gave him feedback, because he directed us to go meet with the political authorities there,” the NSA explained.

Ribadu described Tinubu as “worried and concerned,” and said he directed that all security arms be deployed around the clock.

The government, he added, believes these steps have already produced measurable improvements, even if the situation is not yet 100 per cent safe and secure.

“He’s so worried and concerned, he insisted that enough is enough, and we are working and to ensure that we restore peace and security and all of us are there. The armed forces are there, the Civil Police, intelligence communities, they are there.

“They are working there 24 hours, and we feel that we have done enough to believe that we are on the right course, and we’ll be able to be on top of things,” Ribadu stated.

The NSA emphasised that combating insecurity was not solely a Federal Government responsibility.

He stated, “The issue of insecurity often is not just for the government. It involves the subunits. They are the ones who are directly with the people, especially if some of the challenges are more or less bordering on community problems.

“Not entirely everything is that, but of course it also plays a significant role. You need to work with the communities, the local governments, and the governors, especially the governors.

“The President will continue to direct that. We should be doing that, and that’s what we are able to. We are very happy and very satisfied with the instructions and directives given by Mr. President this evening.”

In Borno State, the NSA noted that while violence had surged in recent months, the insurgents refused to accept defeat.

He warned that most recent casualties there resulted from improvised explosive devices—”cowardly” IED attacks targeting civilians—and from opportunistic raids that follow any lull in fighting.

“We are getting the cooperation of the leadership at the state level, and everybody. It’s not 100 per cent…but we are going there.

“When you are having peace and you are beginning to get used to it, if one bad incident happens, you forget the periods that you enjoyed peacefully,” he added.

He paid tribute to the “many who do not sleep, who walk throughout, who do not go for any break or holiday”—the soldiers, police and intelligence officers whose sacrifices have created the fragile calm Nigerians now experience.

“They will continue to be there,” he said, adding, “Things have changed in this country…we are on the right track and we will not relent. We will not sit down; we will not stop until we are able to achieve results.”

News

FG Laments Low Patronage Of Made-In-Nigeria Products

A Federal Government agency – the National Agency for Science and Engineering Infrastructure, has decried the low patronage of Nigerian-made products by Nigerians.

The agency identified some challenges leading to the low patronage of the local products as affordability and public perception, among others.

Speaking during a stakeholders meeting organised by the agency in Akure, Ondo State capital, yesterday, the Deputy Director of Engineering at NASENI, Mr Joseph Alasoluyi, said Nigerians preferred buying foreign goods compared to local goods.

Alasoluyi, however disclosed that the agency had trained over 50 participants in the production of hand-made products, in a bid to ensure Nigeria-made products are patronised.

He explained that NASENI was set up to promote science, technology, and engineering as a foundation for Nigeria’s development and currently operates 12 institutes nationwide to achieve its objectives.

According to him, the aim of President Bola Tinubu, who is also the overall chairman of NASENI, was to ensure high production and patronage of “our local products thereby creating employment opportunities for many.”

He said, “The idea of this programme is to interface to ensure we produce products using our indigenous technology. This is what NASENI is out for, to ensure that homegrown technologies are encouraged.

“We are out there to ensure we integrate efforts to ensure that local technology is used to develop products within the resources we have.

“ The NASENI’s ‘3 Cs’ – Creation, Collaboration, and Commercialisation – that define NASENI’s strategic mandate: Creating innovations through research, Collaborating with partners to develop and refine products, and Commercialising these solutions to benefit the economy.

“Our achievements include the development of solar irrigation systems, CNG conversion centres, building machines capable of producing up to 1,000 blocks per hour, 10-inch tablets, locally made laptops, and electric tricycles (Keke Napep) set for market launch.”

In his remarks, the Deputy Vice Chancellor of the Federal University of Technology, Akure, Prof. Samuel Oluyamo, blamed the Federal Government for not properly funding research in the varsities, also noting that many research outputs were left halfway due to lack of funding and weak linkages between research institutions and industry.

Oluyamo also queried the Federal Government’s commitment to funding research and development, saying many academic innovations remained on the shelve due to a lack of support for commercialisation and poor infrastructure.

“Until we upscale research into mass production, technological growth will remain elusive. The government is not funding research in the universities enough. Thank God for TETfund that is trying in this regime. The major interest in beefing up research in universities and research institutions is really not there,” he said.

News

Nigeria Seeks Return To JP Morgan Bond Index

The Director-General of the Debt Management Office, Patience Oniha, has said that Nigeria is in advanced discussions with JP Morgan to re-enter the Government Bond Index and renew investors’ confidence.

Oniha disclosed this on Wednesday at a Nigerian Investors’ Forum on the sidelines of the World Bank and International Monetary Fund Spring Meetings in Washington, D.C.

The DMO boss explained that Nigeria has enjoyed favourable credit assessment among rating agencies in recent times on the back of the sweeping reforms initiated by the Central Bank of Nigeria.

Fitch Ratings recently upgraded the Long-Term Issuer Default Ratings of seven Nigerian banks and two bank holding companies to ‘B’ from ‘B-‘, noting that the outlooks are Stable.

The affected issuers are Access Bank Plc, Zenith Bank Plc, United Bank for Africa Plc, Guaranty Trust Bank Limited, Guaranty Trust Holding Company Plc, First HoldCo Plc, First Bank of Nigeria Ltd, Fidelity Bank Plc and Bank of Industry Limited.

The upgrades of the Long-Term IDRs of the banks followed the recent sovereign upgrade and reflect Fitch’s view that Nigeria’s sovereign credit profile has become less of a constraint on the issuers’ standalone creditworthiness, the rating agency said.

Fitch also upgraded Nigeria’s Long-Term IDRs to ‘B’ from ‘B-‘ on 11 April, a decision that reflected increased confidence in the government’s broad commitment to policy reforms implemented since its move to orthodox economic policies in June 2023, including exchange rate liberalisation, monetary policy tightening and steps to end deficit monetisation and remove fuel subsidies.

“These have improved policy coherence and credibility and reduced economic distortions and near-term risks to macroeconomic stability, enhancing resilience in the context of persistent domestic challenges and heightened external risks,” Fitch said.

Nigeria was removed from the JP Morgan index in 2015 ostensibly due to its deviation from orthodox monetary policies and influence of capital control in its management of foreign exchange.

Principally due to reduction in oil revenues at the time, Nigeria introduced currency restrictions to defend the naira after it failed to halt a dangerous slide with burning of dollar reserves. The bank had earlier warned Nigeria to restore liquidity to its currency market in a way that allowed foreign investors tracking the index to conduct transactions with minimal hurdles.

“Foreign investors who track the GBI-EM series continue to face challenges and uncertainty while transacting in the naira due to the lack of a fully functional two-way FX market and limited transparency,” the bank said in a 2015 note.

Nigeria was listed in JP Morgan’s emerging government bond index in October 2012, after the Central Bank removed a requirement that foreign investors hold government bonds for a minimum of one year before exiting.

The JP Morgan Government Bond Index reflects investor confidence and opens doors to billions of investment flows, making Nigeria’s proposed re-entry a positive signal to the market and investors.

Oniha explained that talks with JP Morgan were ongoing and had gained momentum in recent times due to the stability created by the FX market reforms.

“With all the reforms that have taken place, particularly around FX, we have started engaging JP Morgan again to get back into the index. We think we are eligible now,” the DMO DG said.