Business

Revenue Generation: The Rivers Example

When the American economist, Cirero wrote that: “man does not realise how great a revenue economy is”, he was apparently referring to the prime objective of taxation as the bulwark needed to obtain the economic expansion for stable growth and development in any given society.

Today, modernisation of tax systems in line with global best practices and policies has become a major concern of economies and governments. Tax administration is however determined by the peculiar economic environment it operates.

The strategic location and natural disposition of Rivers State makes it a destination for prospective companies and individuals who tap from its enormous economic potentials for their corporal survival.

With such unfettered altraction offered by Rivers State to myriads of corporate organisations with vested business concern, and other fortune seekers, existing infrastructures are stretched.

This places a burden and bulk of responsibilities on the government in terms of provision of basic amenities to cater for the yearning aspirations and spiraling increase in the population of the state.

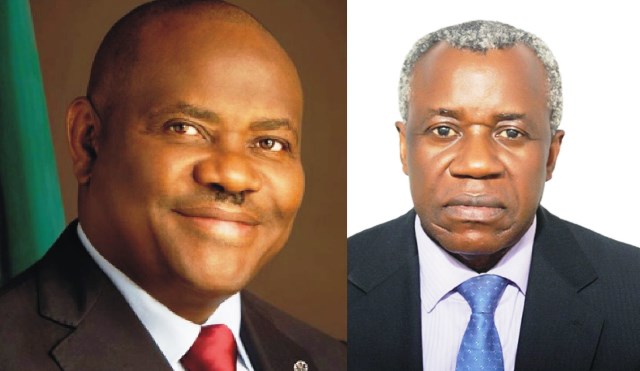

However, determined to live up to its responsibilities of governance, the present administration in Rivers State led by Chief (Barr.) Nyesom Ezenwo Wike has put in place pragmatic reform policies to shore up revenue generation in the state, through effective tax administration.

The new tax regime in the state is premised on the objective that the thrust of governance depends on constant redefinition of goals and vigilance of governance to tackle inefficiencies in administrative procedures.

The first step made by the government of Rivers State is this direction was the reorganisation of the management of the Rivers State Internal Revenue Services. (RIRS).

The new management of (RIRS) assumed office with specific mandate to overhaul the tax administration system in the state and put in place a more robust and compliance friendly regime.

The fundamental objective of the new tax policy is to ensure that all those who do legitimate business in Rivers State pay their taxes accordingly without extraneous influence or doubt in the verification process.

The fact been that the previous system was inundated with the activities of touts who paraded themselves as tax administrators.

Speaking with newsmen during a briefing recently, the Chairman of the Rivers State Internal Revenue Services, Chief Adoage Norteh said the Rivers State Government has introduced on-line transaction in its tax administration to check the errors and palpable defects in the manual system of operation which was previously in use.

The RIRS Chairman said the e-transaction was introduced to encourage voluntary compliance on the part of the tax-paying public, noting that the facilities have component of detecting fraud in the system.

He said: “before we came on board, tax clearance was manual and cumbersome, the process was chaotic and prone to infiltration by touts, but the Rivers State Internal Services introduced an on-line system to make transactions easier for the tax-paying public”.

He pointed out that the new system accommodates complaints and promote 24 hours services, adding that enumerators from (RIRS) were on ground to take data and ensure that income earners pay their taxes accordingly.

While the Rivers State Government is softening the ground for tax-payers in the state to leverage upon, the government has also made bold its resolve to tackle tax evasion headlong.

According to the RIRS chairman, tax defaulters in the state henceforth risk jail as the government will ensure that those with such criminal tendencies are fished out and prosecuted.

As part of its innovations to promote voluntary tax compliance in the state, RIRS has also embarked on the free registration of all eligible tax payers in the state, with strict caution against any monetary demands from anybody including staff of RIRS.

By the new policy which is expected to be fully implemented from the first quarter of 2019, companies are expected to carry out all tax clearance and registration by the end of January 2019, while deadline for individual registration will end in March 2019. The Rivers State Internal Revenue Services, (RIRS) has also made it mandatory that all tax payments must be paid to designated government accounts, while those parading as tax administrators and making cash demands should be treated as touts.

According to the RIRS Chairman, “90% of people parading as tax administrators are touts, task drive from RIRS is conducted in an organised manner, we don’t demand money at the door, all money should be paid to government account”.

Another interesting aspect of the new tax regime in Rivers State, is the nature of its service delivery. The new system is completely devoid of partisan involvement, as it is handled professionally by experts.

This absence of partisan meddlesomeness has given desired impetus to the system to strive, thereby bringing commensurate result.

The RIRS Chairman affirmed this when he declared that the new tax regime in the state has so far recorded significant improvement and checked the inefficiencies of the past.

He said the level of compliance has boosted the internally generated revenue based in the state which has robbed off positively in the development of critical infrastructures.

Although the RIRS Chairman admitted that tax has its darker side, he noted that tax remains the fundamental incentive that builds industries, create jobs and improve the general standards of living of the people.

On the perceived discontent of some people over alleged multiple taxation by the Rivers State Government, the RIRS Chairman said the Rivers State Government was not involved in multiple taxation. Rather he said that Rivers State operates one of the best tax friendly regimes by collecing task on individual earnings, Pay As You Earn (PAYE) and urged the tax-paying public to reciprocate the gesture through voluntary compliance.

The Rivers State Internal Revenue Services (RIRS) also identified inadequate information as the bane of effective tax system.

It therefore blamed some of the misgivings on the part of the tax-paying public on poor information.

As part of measures of ensuring a robust tax regime in the state, the RIRS Chairman said modalities have been concluded to partner with the media to critically engage the tax-paying public through public sensitisation of its activities.

Describing the media, as critical stakeholders in the polity, he said media houses should make it part of their corporate social responsibilities to inform the public on Government policies.

Perhaps one of the major breakthrough in the tax system in Rivers State is the unnerving of the sacred cow syndrome.

Most of the virulent critics of the new tax regime in the state are those that are rooted out of their comfort zones of deliberate tax default. These include company owners who refuse to open up their records for scrutiny, and as such defraud the state government.

According to the Rivers State Internal Revenue Services (RIRS) Chairman, such a deliberate neglect of the tax system is the shortest route to economic ruins and will not be tolerated in Rivers State. It could be recalled that the Rivers State Governor, Nyesom Ezenwo Wike had at different fora, restated the commitment of his administration towards good governance and prudent use of resources for the development of the state.

However, to keep faith with this social contract and public trust, the government also needs to leverage on an improved internally generated revenue based to complement the dwindling federal allocation.

Taneh Beemene

Business

Shipowners Seek NIMASA Officials’ Prosecution Over N50bn Floating Dock Scandal

Shipowners in Nigeria have called for the prosecution of officials of the Nigerian Maritime Administration and Safety Agency (NIMASA) over the failed ?50 billion floating dock project.

This call follows years of inactivity and mounting concerns about the dock’s operational status which has remained idle for years despite huge investments in it.

The floating dock, acquired over a decade ago with the promise of reducing the cost of dry-docking Nigerian vessels abroad, has instead become a liability, incurring massive port charges while remaining non-operational.

Stakeholders in the maritime industry are now demanding accountability, describing the situation as an economic sabotage that has cost the nation billions of naira.

In a chat with our correspondent, a prominent shipowner, Otunba Sola Adewunmi, stated that the entire transaction was fraudulent from the onset.

He lamented that instead of being used for the benefit of Nigerian shipowners, the floating dock has become a symbol of government waste and mismanagement.

“The floating dock acquired by NIMASA was just a joint wastage. Normally, it was just funding for something that we didn’t really need.

“It has been draining the government’s purse all this while. We have wasted so much money on that dock. They will tell you tomorrow that they have found a solution, but nothing happens.

“Go and investigate how much the government is losing. They are paying heavy charges every month for an asset that has never worked”, he said.

Shipowners have expressed outrage over the continuous financial burden imposed on them, blaming the government for failing to create an enabling environment for indigenous operators.

Also, the current DG of NIMASA, Dr. Dayo Mobereola, while meeting with Journalists few months after his appointment in August 2024 had assured that the agency is working on putting the N50 billion modular floating dock to good use.

Mobereola, who spoke during a chart with the media in Lagos, said the management team had visited the site of the floating dock at the Continental Shipyard, Apapa, as part of the efforts to put the facility into good use.

He said: “The initial plan for the floating dock was not the right one. We are going to put the Modular Floating Dock to very good use so that once it’s in operation, it will benefit the economy, seafarers, and NIMASA itself.

“We need to place the modular floating dock in an appropriate location. It is just a matter of time. We will soon get that done”.

Despite these assurances, the floating dock has remained largely inactive, leading to widespread skepticism among industry players.

Speaking further, Otunba Sola Adewunmi said “The time for excuses is over. NIMASA must either operationalize the floating dock immediately, or face legal consequences for their negligence and mismanagement”.

He emphasized that those responsible for the floating dock’s failure must be held accountable, insisting that criminal prosecution was the only way to deter future financial recklessness.

“If those behind this scam were tried and sent to prison, it would serve as a deterrent. But in Nigeria, absurdity thrives because there are no consequences.

“This is a crime against the Nigerian people. The officials who sanctioned this deal should be arrested, tried, and jailed for economic sabotage”, he declared.

Speaking also, another experienced shipowner and Chief Executive Officer of Peacegate, a maritime services provider, Prince Ayorinde Adedoyin, described the floating dock debacle as part of a larger systemic failure where Nigerian authorities refuse to support local shipowners while enabling foreign interests to dominate the sector.

He stressed that the level of wastefulness surrounding the project was unacceptable and called for a full-scale investigation into the acquisition and management of the facility.

“This floating dock issue has been ongoing for about 10 years. Every year, there’s a new excuse. They move it to Marina, then they move it somewhere else.

“This is part of what we call wastefulness. It’s a disgrace. Between NIMASA and NPA, they couldn’t find a way to put the floating dock in use?

“They couldn’t build a docking pit for it? Instead, they allow it to remain idle while Nigerians suffer. This is taxpayer money—our money—being wasted”, he fumed.

He further explained that the failure to operationalize the dock has resulted in unnecessary financial burdens for shipowners, citing his personal experience of having to dry-dock one of his vessels in Cameroon, initially quoted at $180,000 but eventually costing close to $500,000 due to corruption and mismanagement in foreign dockyards.

“This is what Nigerian shipowners go through. Meanwhile, our own floating dock is rotting away because of the greed of a few people”, he added.

The shipowners also accused the government of deliberately frustrating the development of local capacity in the maritime industry.

They stated how Nigerian shipowners struggle with high-interest rates on loans while foreign vessel operators enjoy lower rates and government incentives.

“Foreign vessel owners have a field day in Nigeria. They get loans at 3% interest rates, while Nigerian shipowners are forced to borrow at over 30% interest.

“How can we compete? The government gave a bailout to the airline industry, but nothing for maritime. Meanwhile, shipowners are going bankrupt, and jobs are being lost”, Ayorinde said.

He also alleged that certain officials were benefiting from the floating dock’s continued non-utilization through port charges, legal battles, and consultancy fees, while Nigerian shipowners continued to suffer.

NIMASA has remained largely silent on the issue, with no concrete plans to operationalize the dock despite years of public outcry.

While the agency has occasionally made statements about finding a permanent home for the facility, industry stakeholders view these as empty promises.

“The only thing they know how to do is set up committees and hold endless meetings. No real action.

“If this dock was in the hands of a private company, it would have been operational years ago. But government officials have turned it into a cash cow for their own personal gain”, Ayorinde concluded.

Business

Maritime Journalists Confer Iconic Award On Customs CG

The Comptroller General (CG) of Nigeria Customs Service (NCS), Bashir Adewale Adeniyi, has been conferred with Nigerian Maritime Journalists Iconic Maritime Award with a special commendation for his excellent performance since he assumed office as CGC .

Adeniyi was also hailed for convincing the Federal Government to suspend the implementation of the 4% Free-on-Board (FOB) value on imports into the country.

Speaking at the ceremony for the presentation of “Iconic Maritime Personality of the Year Award 2024” to the CGC by Nigerian Maritime Journalists in Lagos, Thursday, a maritime icon and former National President of Association of Nigeria Licensed Customs Agents (ANLCA), Prince Olayiwola Shittu, said the suspension is a relief to importers and Customs agents.

Calling CGC Adeniyi and the CG of licensed Customs agents and freight forwarders, Shittu, who was the Chairman of the occasion, noted that the CGC was instrumental to his success when he was the National President of ANLCA as he used to guide him through advice.

He congratulated the CGC for the well deserved award coming from maritime journalists, who, he noted, are the watchdogs of the sector.

The Chairman, Customs Consultative Council, Alhaji Hakeem Olanrewaju, eulogized the qualities of CGC Adeniyi and congratulated him for being celebrated by the maritime press with the award of Iconic Maritime Personality of the Year 2024.

Olanrewaju called the attention of Customs licensed agents to the fact that things have changed and enjoined his colleagues in the freight forwarding business to have attitudinal change.

The Vice President, ANLCA, Prince Olusegun Oduntan, commended the CGC for being a grassroots leader who listens to the people, an attitude, he said, that has brought a positive change.

He promised that his association will continue to partner with Nigeria Customs under the CGC’s leadership.

In his own speech, the National President, Africa Association of Professional Freight Forwarders and Logistics of Nigeria (APFFLON), Otunba Frank Ogunojemite, described the CGC as a downright good man and a natural leader.

He stated that the CGC was his class captain in the university and later the President of the department, adding that he was a sports enthusiast who later became the leader of Man ‘o’ War.

Describing him as extremely patriotic and very humble, he said the CGC has been keeping his old friends without looking at his present status.

Speaking on behalf of the maritime journalists, Mr. Oke Ibeke, commended CGC Adeniyi for his “superlative performance” which has changed the narrative in Customs.

Ibeke commended the CGC for delivering on his mandate in areas of revenue collection, anti-smuggling activities, trade facilitation and others.

He noted that this was the first time journalists from various media houses covering a sector would agree jointly to honour a Chief Executive Officer of an agency.

Ibeke noted that the unusual agreement was not for sycophancy “but to give honour to a man who is a game changer”.

He expressed the belief that President Bola Tinubu must have seen in the CGC special qualities of an accomplished administrator before making him the CGC, adding that he has not disappointed the President for once.

Emphasizing that Customs is key to the economic development of any nation, Ibeke called on the Federal Government to give the Service more power and political support to be able to deliver better on its mandate.

Business

NCS Hands Over Intercepted Arms To NCCSALW

The Nigeria Customs Service (NCS) has handed over 1,599 assorted arms and 2,298 live cartridges to the National Centre for the Control of Small Arms and Light Weapons (NCCSALW).

The arms, seized in 2018 in three containers at the Tin Can Island Port, were formally handed over to the NCCSALW on Thursday, 13 February 2025, at the headquarters of the Federal Operations Unit, Zone ‘A’, Ikeja, Lagos.

The Comptroller-General of Customs (CGC), Adewale Adeniyi, stated that the handover ceremony demonstrates the NCS’s commitment to protecting national borders and maintaining public safety.

“We will spare no resource in hunting down, exposing, and prosecuting anyone who attempts to compromise our national security through arms trafficking”, he said.

The CGC also commended the professionalism and courage of officers involved in the seizures and the Forensic Unit for their role in securing convictions.

He assured the public of the Service’s commitment to protecting legitimate trade while ensuring national security.

“We stand ready to deploy our full arsenal of intelligence and enforcement capabilities to protect legitimate trade as we ensure Nigeria’s security interests remain paramount”, he added.

The Director-General of NCCSALW, DIG Johnson Babatunde (Rtd), received the items on behalf of the National Security Adviser, Mallam Nuhu Ribadu.

He assured that the weapons would be handled in accordance with international conventions.

“Nigeria is a signatory to the ECOWAS Convention, and we will not do anything short of international best practice”, he said.

He urged all stakeholders to remain vigilant and to continue collaborating to ensure the country remains resilient against the scourge of illicit weaponry.