Editorial

No To Pension Fund Borrowing

Being a country most notorious for borrowings, it does not come across as a consternation that Nigeria would ask to take a N2 trillion loan from the dedicated Pension Fund. Expectedly, the proposal has raised the ire of labour unions, workers, groups and critical stakeholders who have vehemently repudiated the idea. Despite that, the federal government seems intent on going ahead with the planned action.

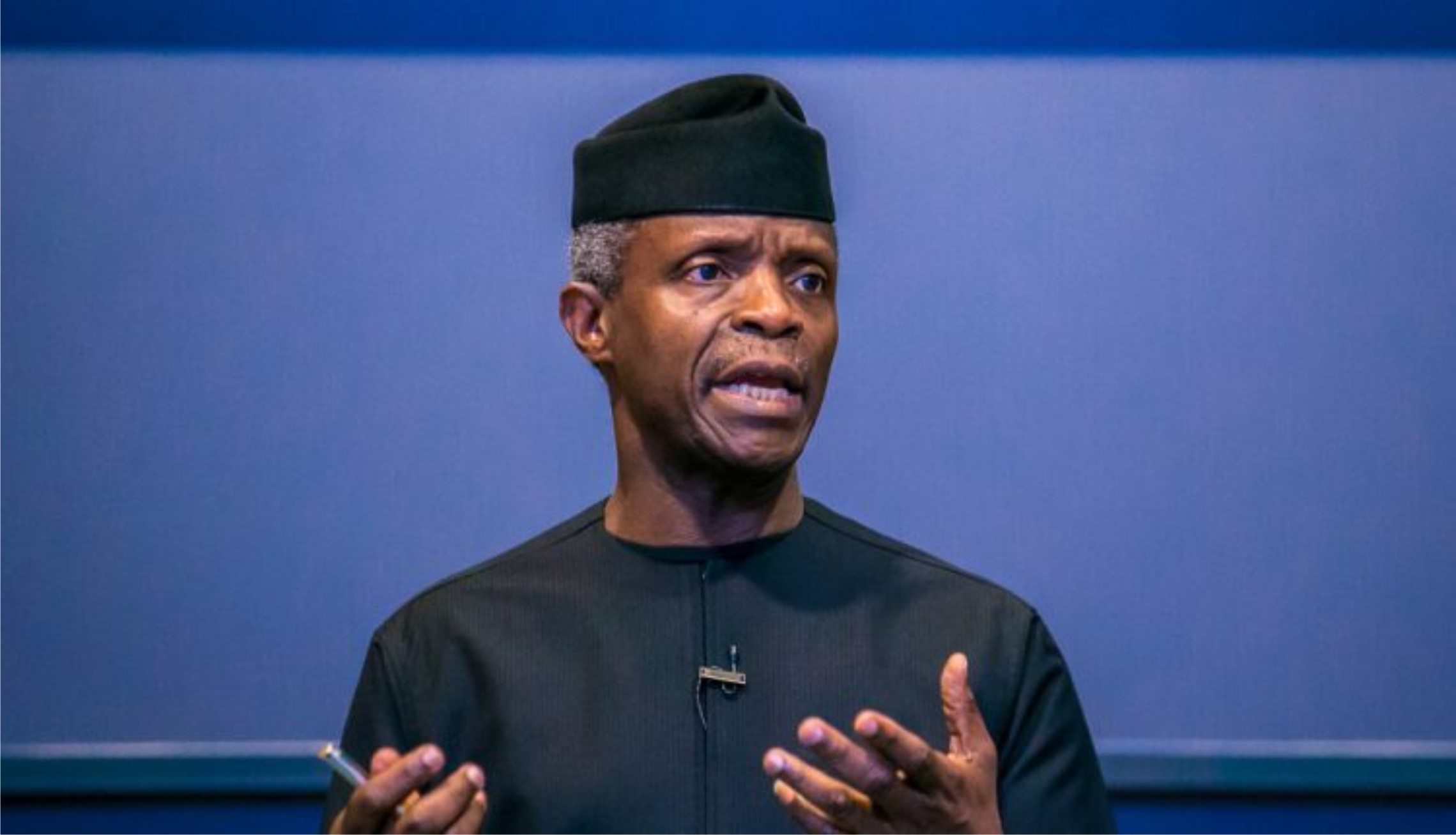

The Vice President, Prof Yemi Osinbajo, confirmed the government’s position at the National Economic Council (NEC) meeting he presided lately where he revealed that plans had been perfected to take N2 trillion from the current N10 trillion domiciled in the pension till to finance the rejuvenation of decomposing infrastructure.

However, if the glitches that characterised the pension schemes prior to 2004 are anything to go by, then, this is a fatal move that must be halted. Our suspicion is deepened by the fact that at the moment, the government’s indebtedness to pensions in accrued rights, pension differentials, minimum pension guarantee, pension increase is well over N400 billion.

Government needs to be reminded that the Contributory Pension Scheme came into existence in 2004 to replace the moribund Defined Pension Scheme. It is fully funded by workers and employers and privately managed by Pension Fund Administrators. The monies are in the individual Retirement Savings Account (RSA). Therefore, it is significant that the consent of the workers is, at least, sought.

While infrastructure is a colossal asset around the world, and especially in most advanced countries in which private investors could invest Pension Fund and make high returns, here, infrastructure is yet to be an asset because Nigeria runs a dysfunctional economy, morbidly dependent on crude oil revenue. It is an economy that sustains enormous corruption and relies ponderously on the importation of goods and services that can effortlessly be generated here.

A recent Central Bank of Nigeria (CBN) report indicated that the Federal Government registered N4.62 trillion deficit in 2019. That year, its highest expenditure went on recurrent at N4.05 trillion out of a budget of N8.9 trillion. This is certainly an unworkable economic exemplification. A country which keeps allocating more resources to consumption cannot guarantee that the funds its government seeks to borrow will not be frittered on politicians and civil servants.

We firmly believe that the government does not have to borrow to erect or maintain infrastructure if it can cut on its garish lifestyle. For example, besides the prodigious sums expended on federal lawmakers, fuel subsidy alone cost the nation N2.95 trillion in 2018. With this, we find it hard to comprehend why the four refineries that gulped about $400 million between 2013 and 2015 cannot be auctioned to private investors who can run them efficiently.

Again, a report by the Debt Management Office (DMO) stated that as of September 2019, Nigeria had a debt profile of N26.21 trillion or $85.3 billion while debt servicing alone costs N2 trillion annually on average. This has more severely compromised the nation’s debt-to-GDP ratio. The obvious implication is that the current ratio cannot sustain a serious borrowing any longer. So, what is the repayment plan for the N2 trillion when debt servicing guzzles so much?

In a surprisingly bold statement, the Federal Government claims it needs the N2 trillion to plough into infrastructural upswings like the rails, roads and power. These are desirable projects, no doubt, but it will be harmful to divert pension capital to them. In the first place, it doesn’t make sense to keep plunging public funds into power when in the privatisation exercise of November 2013, N1.7 trillion was disbursed to stabilise the sector without the anticipated result. The way it is, if the entire N2 trillion is assigned to the sector, no improvement may be recorded.

During the 2008 economic crisis, the Assets Management Corporation of Nigeria deployed N5 trillion to bail out some ailing firms. But because there is a consistent dearth of political will in the country, that large sum is yet to be recouped by various administrations till date. Why look elsewhere when this money is more than twice the N2 trillion being sought for? Furthermore, what happened to funds granted private organisations like the Aviation Fund and Textile Fund? Of course, they have gone down the drain and unaccounted for while the culprits walk unhindered.

It is a fact that pension depositories are used to construct infrastructure in developed countries, particularly those with a vast ratio of Pension Fund to GDP. However, with a Pension Fund to GDP ratio of 6.7 per cent, Nigeria cannot cut a slice of its pension reserves to invest in infrastructure without jeopardising workers’ fortune. To be suitable to do that, our infrastructure market must be developed and well regulated.

We express grave concern at the fate of Nigerian workers in the face of incessant borrowings by our governments without corresponding development. It is unthinkable to borrow from the Pension Fund when the citizens have not felt the impact of the mounting debts foisted on the country. What is paramount to contributors and other stakeholders alike is the safety of the Fund, which, unfortunately, government cannot guarantee. This action of government has the potential to threaten the scheme and erode contributors’ confidence.

Accordingly, we strongly apprise the federal government to think twice and desist from overstepping the Pension Reform Act 2004 to gratify its crave to build infrastructure. This was the issue with Argentina when its then President, Cristina Fernandez, manoeuvred the parliament and clutched the country’s $30 billion Pension Fund. Instantly, international investors’ confidence wiggled and the economy went into a free fall.

As the regulatory agency, the National Pension Commission (PenCom) should not subject pension revenue to undue hazard by granting political office holders access to the Fund. Like birds of passage, politicians have no stake in the pension money; as such, they have to be prevented by all means from intruding on the future of Nigerian workers. The government with their itchy fingers should maintain a distance from the pension proceeds to stave off Argentina’s ugly experience.

·

· · ·

Editorial

Reforming Nigeria’s Prison Crises

The news of the Koton Karfe prison break in Kogi State, were met with a degree of resignation, underscores a

deeply troubling and recurrent crisis within Nigeria’s correctional system. The escape of 12 inmates, despite the swift recapture of a few, serves as a reminder of the vulnerabilities plaguing these facilities. This incident is not an isolated event, but rather the latest chapter in a well-documented history of prison breaches across the country.

From the Ikoyi riot in 2004 to the more recent, and devastating, escapes linked to the #EndSARS protests, the pattern is clear: Nigerian prisons are struggling to maintain security and prevent inmates from absconding. The chilling detail of an escaped inmate immediately murdering a witness further highlights the grave consequences and potential societal impact of these failures. The sheer scale of the problem, with over 5,238 inmates escaping during 15 jailbreaks in just two years, demands urgent and comprehensive attention.

Nigeria’s correctional system is in dire need of comprehensive and urgent reform, as evidenced by a confluence of deeply troubling issues. Senate President Godswill Akpabio’s observation regarding the increased frequency of jailbreaks since the transition from Nigeria Prisons Service to Nigeria Correctional Service highlights a systemic failure in maintaining secure facilities and rehabilitative programmes.

Furthermore, public trust is eroded by credibility crises, such as the alleged premature release of crossdresser Bobrisky in 2024, suggesting potential corruption or preferential treatment within the system. Adding to this already alarming situation is the overwhelming number of awaiting-trial inmates. Of the approximately 79,863 individuals currently incarcerated, a staggering 70 per cent (53,254) are yet to be convicted, pointing to severe inefficiencies and delays within the judicial process.

Perhaps, most damning is the revelation that children constitute a reported 30 per cent of the correctional population, a statistic that shames the nation and underscores the urgent need for age-appropriate justice and rehabilitation mechanisms, moving away from simply warehousing vulnerable youth within an overburdened and ineffective system.

The penal system, fundamentally toxic at its core, suffers from a crippling combination of systemic neglect and inherent flaws. Severely underfunded and perpetually overcrowded, prisons are often characterised by crumbling infrastructure, inadequate healthcare access, and absence of meaningful rehabilitation programmes. This confluence of detrimental factors cultivates an inhumane environment that actively undermines any potential for reform, instead fostering resentment and potentially hardening inmates into more serious criminals.

The strain on resources is painfully evident even in the most basic provisions, clearly illustrated by the inadequacy of feeding allowances. While the Federal Government’s recent increase of the daily allowance from N750 to N1,125 per inmate represents a step forward, it remains grossly insufficient to provide proper nutrition, showing the pervasive and deeply ingrained nature of the problem.

The justice system is plagued by systemic inefficiencies and ethical breaches, which creates a breeding ground for injustice and exacerbating societal problems. Unacceptable delays bog down the courts, compounded by archaic manual record-keeping systems that lead to lost files and impede the swift administration of justice. The integrity of evidence is further compromised by the alleged admission of forced confessions without proper verification, raising serious concerns about due process.

This flawed system allows for the regular arrest and detention of innocent individuals, who then suffer the indignity of prolonged incarceration. Compounding these issues are credible reports of dehumanising treatment of detainees, and allegations of collusion between security agents and magistrates to unlawfully prolong custody. These failures erode public trust and create a dangerous cycle, plausibly contributing to the rise in violent crime as prison escapees, potentially radicalised or hardened by their experiences, may resort to armed robbery, banditry, terrorism, and kidnapping.

The justice system’s deep-seated flaws cultivate a breeding ground for further crime and erode public safety. Crippled by systemic delays, reliance on antiquated manual processes, and the alarming acceptance of potentially coerced confessions, the system frequently fails to deliver justice and protect the innocent. The routine arrest of innocent individuals, followed by prolonged and unjust detention, points to a broken process ripe for exploitation. Dehumanising treatment within detention facilities, coupled with alleged collusion between security agents and magistrates to circumvent due process, fosters a climate of mistrust and fuels resentment.

This dysfunction extends beyond individual injustices, potentially contributing to broader societal problems. The escape of prisoners, some of whom may then engage in violent crimes demonstrates the tangible threat these failures pose to public safety. The tragic events at St. Francis Catholic Church in Owo, allegedly perpetrated by escaped ISWAP members, serve as an illustration of the devastating consequences stemming from a broken and permeable justice system.

The Nigerian prison system faces a multitude of challenges, but glimmers of hope shine through. The graduation of 1,229 inmates from the National Open University of Nigeria serves as powerful evidence of rehabilitation’s potential when individuals are afforded proper educational opportunities. To further bolster this potential and address systemic issues, a shift towards true federalism with devolved prison management is necessary.

If states and local government areas establish their own custodial centres, a decentralised system can be created where suspects are housed closer to their respective jurisdictions, potentially easing overcrowding at the federal level. Simultaneously, the Federal Government must deliver on its promise to construct new custodial centres and relocate existing ones from densely populated areas. This infrastructural improvement, coupled with a rigorous vetting process to prevent wrongful incarceration, will significantly reduce the burden on the system.

Nigeria should look beyond its borders, studying and adopting best practices in prison modernisation from countries with successful rehabilitation-focused correctional systems. By prioritising rehabilitation over mere punishment, and implementing strategic reforms, Nigeria can transform its correctional system into one that fosters positive change and contributes to a safer society.

Editorial

Easter: A Call For National Renewal

Yesterday was Easter Sunday, a day when Christians around the world celebrate their belief that Jesus Christ rose from the dead after being crucified and buried. The day is a moment for deep reflection and spiritual renewal. The Lenten season before Easter promotes self-examination, fasting, and prayers to help believers grow closer to God. This time of reflection leads to the joyful celebration of resurrection. The Risen Christ represents hope and the promise of life after death, highlighting themes of love, sacrifice, forgiveness, and reconciliation.

For those who truly understand Easter as celebrating life’s victory over death, the resurrection of Jesus of Nazareth—unjustly executed by Roman authorities—represents justice overcoming injustice, love conquering hatred, and divine compassion transcending human malice. This Easter message challenges humanity broadly and Nigerians specifically. Amid politics often devoid of morality, Easter calls us to prioritise the power of love over the love of power.

This year, Nigerians marked Easter amid a climate of insecurity, with citizens facing abduction for ransom on streets and from homes, and murder on farms and in places of worship. For many years, Nigeria has been entombed in darkness of injustice, sealed with the heavy stone of oppression. This oppression weighs down millions of citizens, preventing them from realising their God-given potential. Our national history reflects disturbing uncertainty and unnecessary, avoidable hardship for many.

Many individuals who pursue or currently occupy positions of public office have unfortunately succumbed to a distinctive form of blindness that accompanies power—a perceptual impairment that renders them unable to recognise a fundamental truth: that no nation built upon the foundation of injustice can truly endure or thrive in the long term. This deliberate refusal to see reality clearly has, over generations, enabled and perpetuated destructive cycles of inadequate governance, institutional failure, and widespread suffering among the very populations these officials have sworn to serve.

Beyond Easter’s religious festivities, we must confront the reality that our population has often fallen prey to dubious religiosity, fake patriotism, and criminally deceitful politics. Nigeria stands as a land immensely blessed by the Creator yet mindlessly damaged by negative attitudes of both leaders and citizens. Despite abundant natural endowments, our country remains populated by impoverished people.

An alarming number of young Nigerians are succumbing to despair. They see no future in their homeland and actively seek opportunities to leave a country that offers little hope to its children. Yet, Nigeria can and should rise from this tomb of hopelessness—Easter’s celebration symbolises precisely this restoration of hope in seemingly impossible circumstances.

Our collective hope must be rekindled and nurtured back to full strength. All Nigerians—from those in the highest positions of leadership to everyday citizens in communities across the nation—need to work diligently and conscientiously toward rebuilding and restoring genuine hope for the younger generation who represent our future. This essential task requires tangible, meaningful actions that clearly demonstrate a sincere commitment to positive, sustainable change rather than continuing the pattern of empty rhetoric and unfulfilled promises that has too often characterised past efforts.

If we genuinely wish to celebrate Jesus’ resurrection and apply its meaning to our national situation, we must resolve to operate differently. We must commit to building a nation where oppression has no place, where elections proceed without acrimony or ethnic profiling, where voter intimidation and vote buying are eliminated, and where results reflect the true will of the people.

Easter encapsulates the profound message of new beginnings and spiritual renewal, challenging us to apply these transformative principles to the rebirth of Nigeria by wholeheartedly embracing and actualising our lofty ideals. Indeed, the generations yet unborn, who will inherit the Nigeria we shape today through our actions and commitments, deserve nothing less than a thoroughly transformed country that lives up to its full potential as the giant of Africa.

For this new Nigeria to emerge, each citizen must commit to living with a completely renewed attitude. We must embrace transformation at both personal and collective levels. The journey toward national renewal begins with individual change—in our homes, workplaces, and communities. Easter should be understood not merely as a celebration but as a sacred obligation to our nation and one another. It represents a profound opportunity for rebirth and restoration. Just as the Easter story speaks of sacrifice leading to new life, our nation requires our collective sacrifice and dedication to experience true renewal.

This season imposes upon us the responsibility to rise from the dark tomb into which greed and selfishness have pushed us, embracing a new life dedicated to truth, goodness, and love. If Nigerians continue with business as usual—maintaining corrupt practices and self-serving attitudes—there would be no legitimate cause for celebration. Indeed, the true meaning of Easter for Nigeria lies not in festivities alone but in our collective determination to resurrect our nation from its current challenges toward a brighter, more hopeful future.

Editorial

NAFDAC’s Destruction Of Counterfeit Drugs

Last Friday, the National Agency for Food and Drug Administration and Control (NAFDAC) destroyed fake, counterfeit and substandard drugs worth over N1 trillion in Awka, the Anambra State capital. Recall that for one month, NAFDAC shut the Onitsha Drug Market, restricting shop owners from coming to the market, barricading it with military personnel, while officials broke into and ransacked shops in search of fake drugs.

NAFDAC’s Zonal Director for South-East, Dr. Martin Iluyomade, revealed some of the drugs destroyed to include Analgin, Tramadol, and various paediatric pharmaceuticals, which had been stored in prohibited areas or were banned by the World Health Organisation (WHO). Iluyomade said the closure and raids of the markets where the drugs were confiscated was in response to public complaints regarding the prevalence of fake, substandard and counterfeit drugs in the South-East.

He said: “Many of these drugs are banned, such as Analgin and certain paediatric medications, and they were stored in places that violate WHO regulations. It is our responsibility to ensure that these products are safe and fit for human consumption. These drugs were transported in a 140-foot truck, valued at over N1trillion, and were supposed to be stored at specific temperatures. However, they were kept in markets that do not meet the required standards.

“The volume of drugs found in these two markets could destabilise the country, and many of these are narcotic drugs associated with criminal activities. People who consume these drugs are not only harming themselves but also using them to commit crimes, which contributes to the growing insecurity in our country.”

Unfortunately, that is the chilling reality of counterfeit drugs, and it is a problem NAFDAC is relentlessly fighting. This dramatic action underscores the monumental scale of the problem and the unwavering commitment of NAFDAC to protect public health. The massive destruction highlights the pervasive nature of the counterfeit drug trade and the resources NAFDAC dedicates to combatting it.

Counterfeit drugs are dangerous, even deadly. They can contain the wrong dosage, the wrong active ingredients, or even harmful substances. Imagine taking a pill you believe will cure your illness, only to find it contains something entirely different – something that could worsen human condition or even kill. That is the terrifying reality of the counterfeit drug market.

The insidious world of counterfeit medications poses a grave threat, as these fake drugs often harbour toxic fillers or entirely different, untested chemicals. The consumption of such substances can trigger a cascade of adverse reactions, varying from minor allergic responses to catastrophic organ failure, leaving vulnerable individuals severely harmed. In this critical battle for public health, NAFDAC stands as our frontline defender.

Through tireless monitoring, rigorous inspections, and decisive action against those who peddle these dangerous fakes, NAFDAC acts as a vital gatekeeper, ensuring the safety and efficacy of the medications we depend on. Supporting NAFDAC’s mission is paramount, as it directly equates to safeguarding the lives and well-being of our Nigerians by preventing the proliferation of these harmful and potentially lethal counterfeit medications.

Given the breadth and criticality of NAFDAC’s mandate – regulating everything from food and drugs to cosmetics and medical devices – it is imperative that the Federal Government bolsters the agency’s resources and capabilities. This monumental task, encompassing the entire lifecycle of regulated products from importation to usage, demands substantial investment in infrastructure, advanced technological tools, and a highly skilled workforce.

Under-resourcing NAFDAC risks compromising its ability to effectively monitor and enforce regulations, potentially leading to substandard or counterfeit products entering the market, with devastating consequences for public health and safety. Therefore, increased funding, enhanced training programmes, and optimised operational systems are essential to fortify the agency’s effectiveness and ensure it can continue to protect the Nigerian populace.

No doubt, NAFDAC currently faces numerous hurdles in fulfilling its mandate. These challenges range from inadequate funding and outdated equipment to a lack of personnel and poor training. Insufficient funding directly translates to limited capacity for effective inspection, testing, and enforcement. Imagine trying to police a vast country with only a handful of officers – the task becomes virtually impossible. This lack of resources allows substandard and even dangerous products to enter the market, posing serious risks to public health.

The Federal Government must prioritise NAFDAC’s needs and take decisive action to support, equip, and empower this vital agency. NAFDAC is a cornerstone of public health in Nigeria and its health and economic well-being depend on its support. By providing financial, technological, and human resources, the government can strengthen the organisation’s capacity to protect Nigerians and contribute to national development. Tinubu’s administration must ensure that NAFDAC had the tools it needs to succeed. The lives of millions depend on it.

-

News2 days ago

Army Chief Gives Troops One Month Marching Order To Flush Out Bandits In Niger, Kwara

-

Nation2 days ago

Nation2 days agoMonarch Preaches Peace As He Unveils Palace

-

Niger Delta2 days ago

Eno Promotes ARISE Coordinator To Perm Sec

-

Business2 days ago

Multipurpose Terminal Hosts 6,606-Foot Capacity Vessel In Onne

-

Politics2 days ago

Speakers Conference Tasks FG, Governors On Wanton Killings

-

News2 days ago

Court Okays Arrest, Detention Of Six CBEX Promoters

-

Featured2 days ago

Featured2 days agoFG To Seize Retirees’ Property Over Unpaid Housing Loans

-

Niger Delta2 days ago

Diri Okays Ongoing Projects’ Progress