Business

Subsidy Removal: ‘Good For Investment, To Check Rising Debt’

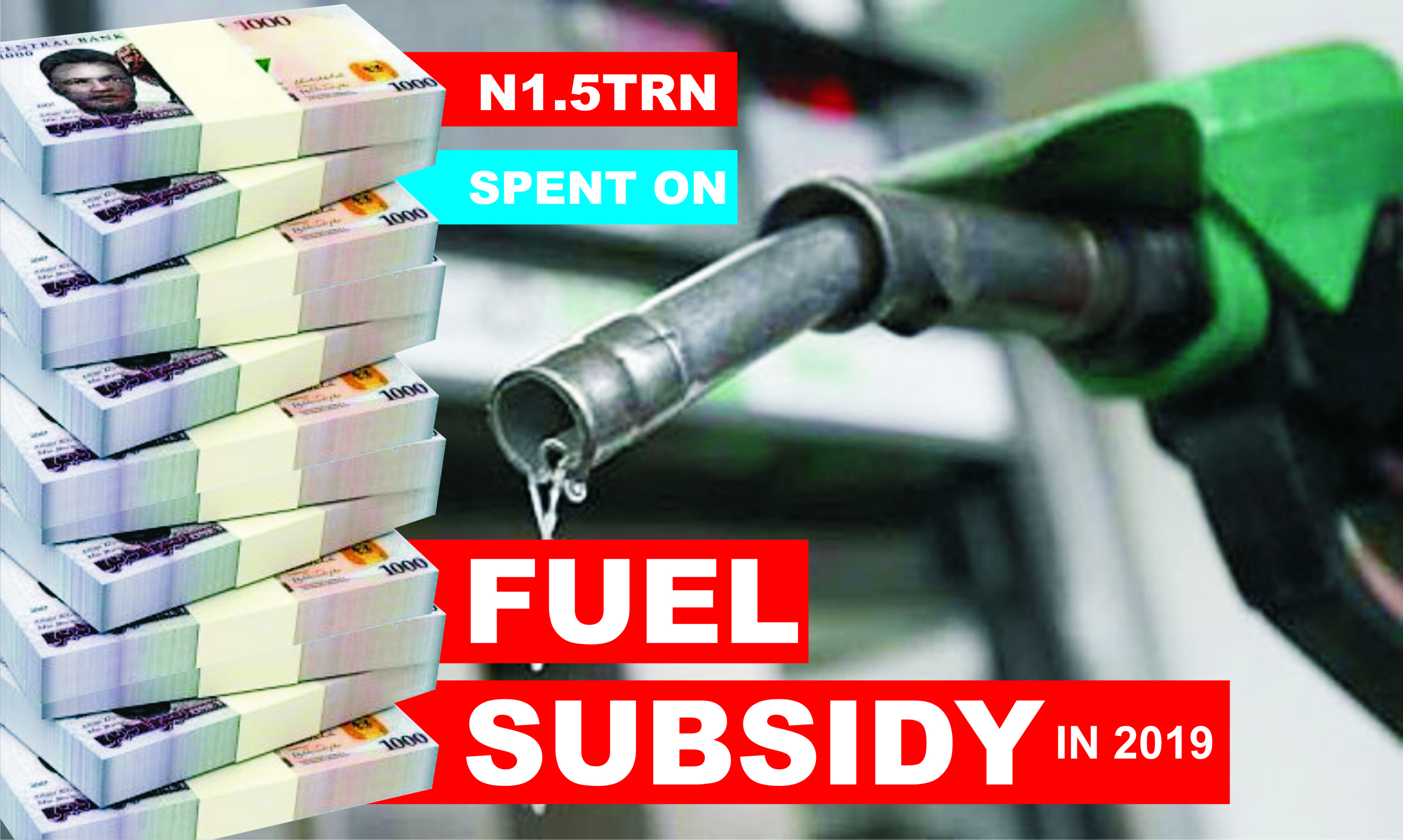

The Lagos Chamber of Commerce and Industry (LCCI) has said the Federal Government’s planned removal of petrol subsidy remains one of the best economic decisions that will not only reduce Nigeria’s debts, but will also tackle widespread corruption in the oil sector.

President of LCCI, Dr Michael Olawale-Cole, stated this during the chamber’s second quarter state of the economy conference yesterday in Lagos.

Recall that Nigeria secured an $800 million relief package from the World Bank to minimise the effect of subsidy removal on the most vulnerable in the society.

Recent data by the Debt Management Office puts Nigeria’s public debt at N46.25 trillion ($103.11 billion) as at end-December 2022, compared to N39.56 trillion ($95.77 billion) in 2021.

Olawale-Cole urged the Federal Government to begin to roll out several cushioning measures ahead of the subsidy removal in the second half of the year to mitigate any likely disruptions to the economy.

“Removal of fuel subsidies is, amongst others, expected to spur investments in domestic refining and petrochemicals and create a significant value chain for the various stakeholders.

“Though the planned removal of fuel subsidies may cause further northward movement of inflation in the short term, it is arguably one of the best economic decisions to reduce our unsustainable debts and widespread corruption in that sector.

“The government must, however, take cognisance of its socio-economic implications, especially with unemployment at the unwholesome rate of about 40 per cent”, he said.

The LCCI’s boss picked holes in borrowing to fund subsidies or support uneconomic ventures, saying the government’s fixation on debt accumulation was unhealthy.

He said the government must prioritise exploring other avenues, including opening equity opportunities, offloading/selling of its real estate holdings and tackling oil theft to create room for fiscal manipulation.

Olawale-Cole stressed the need to importantly follow the recently launched and restructured Ministry of Finance Incorporated (MOFI) by President Muhammadu Buhari on February 1, to optimise national assets.

He advised that copious references should henceforth be made on the growth and returns of the country’s stock of financial assets in corporate equities, real estate and infrastructure spaces.

This, he said, would provide local and global observers a balanced picture of our financial position.

“It would also motivate national asset managers, led by MOFI, to grow our assets and the returns on them as well as motivate our national liability managers, led by the DMO, to minimise our liabilities and the costs we incur on them with equal vigour.

“Indeed, issuance of joint reports by MOFI and DMO would be most ideal going forward.

“One-sided updates on liabilities with no updates on assets when such updates were adequately available could well be blamed for some of the downgrades of Nigeria’s debt issuance risk profile and outlook.

“The rating outcomes would have been more favourable, had updates on assets been provided side-by-side with updates about liabilities”, he stated.

Addressing inflationary pressure which inched upwards in March to 22.04 per cent, Olawale-Cole noted that hiking monetary policy rate had thus far proven to be ineffective and insufficient in taming inflation.

He stated that in most economies, amid the cost-of-living crisis, the priorities remained achieving sustained disinflation and reasonable real growth.

Business

Bank Supports Female Entrepreneurs With Grants

Kolomoni Microfinance Bank has awarded grants to five female entrepreneurs to boost their businesses as part of its commitment to promoting women in business.

The initiative, organized to mark International Women’s Day, was themed “Accelerate Her Growth.”

According to the bank, the decision to support women was inspired by World Bank data, which shows that 41 percent of Nigeria’s micro-businesses are owned by women.

Delivering the keynote address, business strategist, Ebun Akinwale, emphasized that entrepreneurship requires resilience, creativity, and passion.

She illustrated this by recounting her own business challenges and highlighting the critical role passion plays in overcoming obstacles.

The event underscored Kolomoni’s mission to empower women and support small businesses in Nigeria.

Other speakers at the occasion were Odunayo Oyebolu, a seasoned entrepreneur; Victori Ajiboye, a marketing strategist with global experience; and Simi Ojumu, a finance expert.

The beneficiaries said the financial support was a validation of their hard work and a boost of confidence towards scaling through in their businesses.

The winners were selected after sharing their entrepreneurial journeys and presenting business proposals for financial assistance from the bank.

Business

Nigerian SME Awards: Providus, Access, Others Compete For Honor

The 8th edition of the Nigeria Small and Medium Enterprises (SMEs) Summit and Awards (Nigeria SMEAwards) is set to take place in Lagos for the first time in its history, marking a significant milestone for this prestigious event.

Endorsed by the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), the annual awards celebrate the entrepreneurial spirit driving Nigeria’s economy.

The visionary convener of NigeriaSMEAwards 2025, Adedayo Olalekan, said, “Governors from Zamfara, Sokoto, Ebonyi, Borno, Enugu, Ekiti, Benue, and Kaduna States have all implemented transformative initiatives that have greatly benefitted local enterprises.

“Their contributions will serve as a beacon of inspiration for the nation.”

Speaking at a recent press conference in Lagos, Olalekan emphasised that the event would introduce a fresh and unique approach, moving away from tradition.

“Despite economic challenges, Nigerians continue to show an unwavering commitment to progress”, he said.

He noted that the awards will not only honor outstanding individuals, but also recognise the critical role state governments play in nurturing vibrant SMEs.

“State governments have been instrumental in fostering a supportive environment for SMEs, which in turn benefits both the awardees and the larger economy.

“With major banks like Providus, Access, and First Banks competing for top honors, the 8th NigeriaSMEAwards promises to be a night of celebration, recognising exceptional contributions to Nigeria’s SME landscape”, Olalekan added.

Amid global challenges such as inflation, geopolitical instability, and the ongoing conflict in Ukraine, Nigerians continue to show remarkable resilience.

Their efforts, according to reports, have contributed to job creation, economic growth, and overall prosperity, with SMEs at the forefront of this success.

This year’s awards will recognise governors who have made significant strides in advancing the SME sector within their states.

Business

SMEs Experts Urge MSMEs To Remain Focused

Small and Medium Enterprises (SMEs) consultants in Rivers State have called on entrepreneurs to be focused and avoid distractions.

The experts, who were speaking on the recent developments about the change of leadership in the state, said entrepreneurs need to put more efforts in their businesses in order to break even in the present situation in Rivers State.

Speaking in a chat with The Tide, an international SMEs consultant, Amb. Larry Goodwill Ajiola, said the political moves is capable of distracting SMEs who are not grounded in their businesses, adding that “the serious minded business men and women would utilise the opportunity to increase their revenues”.

Amb Ajiola, who is the President and Chief Executive Officer (CEO) of Rumuomasi Co-operative and Credit Society Limited, Port Harcourt, said, “Rugged entrepreneurs look out for business opportunities in situations around them, whether good or bad”.

He reiterated that the loan facility given to 3,000 SMEs in the state revived and expanded businesses, adding that the empowered businesses should continue to push, no matter the situation.

“credit is a powerful tool for achieving financial security.

“We can only keep imagin the economic value that the over 3,000 MSMEs would add to the positive economic dynamics of Rivers State and the Local Government Areas in terms of Gross Domestic Prooduct (GDP), increased tax returns, employment creation, income distribution, and production of goods and services”, he said.

Another SMEs Expert, a business consultant and SMEs trainer, Mr. Chisom Sam-Orji, in his advice, noted that every SME in the state should realize that change is the only constant thing.

He said SMEs should also know that “tough times never last, but tough people do”, adding the need for every entrepreneur to stay focused on creating value and remain resilient.

“This is not the time to be distracted by every noise around your space, but to maximize every time you have to focus on the essentials and keep creating value.

“For some people, it may just be the time to diversify, create new products and services to serve a new or existing market. But this must be based on the facts available to you via research and market surveys”, he said.

The SMEs expert also said the present time in the life of an entrepreneur is a time to cut off unnecessary excesses that surround one’s business.

“Those extra costs that may hamper your growth in this season and beyond, and focus on just essentials.

“SMEs should find certain leverages that are available to aid their business growth. This could be in form of grants, knowledge, and other leverage tools.

“Collaboration is one big way to grow in this season. Finding ways to collaborate with like minds instead of competing could enable a product or service gain advantage in the market and beyond.

“They should also find ways to sustain and grow their customer relationship as this is key to sustaining business flow. They must seek new and efficient ways to serve their customers and gain their loyalty”, he stated.

He further called on every entrepreneur to keep building capacity and never take their eyes off their visions, adding the need to muster every courage it takes to keep building and moving forward.

Lilian Peters