News

Vested Interest Killing Nigeria -Sanusi

Central Bank of Nigeria (CBN) Governor, Malam Sanusi Lamido Sanusi, says the huge vested interest of economic and political officeholders has been the major barrier to Nigeria realising its huge economic potential.

Speaking on the topic “Overcoming the fear of vested interest” on an occasion organised by a group of youth under the aegis of TEDx in Abuja, Sanusi said that, in 1960, Nigeria was the preferred investment destination with per capita income higher than that of countries like Japan and South Korea.

However, over 53 years later, he said, Nigeria which has always had potential is still not able to realise that potential when countries like China, Indonesia, Japan, Korea, Vietnam and Brazil have since turned the potential that they had into reality.

“In four years or so that I have been in Abuja, I have come to understand that we need to overcome the power of vested interest. And I will talk with you a little bit about my own experiences at the Central Bank and use that as a basis or template for what I think we need to do if we must change this country,” Sanusi said.

Since the discovery of oil, the Nigerian state has been exploited to serve the vested interest of the rich minority at the expense of the poor majority, he noted.

The CBN governor highlighted some instances where vested interest took precedence over public interest in the country in the banking sector, petroleum subsidy scandals, among others, and urged the youth to use these as examples of what they can do if they want to confront these vested interests and deal with them and protect the poor people of this country.

“The fundamental character of the Nigerian state is that, for decades, since we found oil it has existed not to serve the people but as a site for rent extraction to serve a tiny minority in the country’s political power. And it doesn’t matter where this group comes from – whether it is north or south or Muslim or Christian or military or civilian. The state has always been a site for rent seeking with the exception of a few years when we have had development. And this is at the heart of the problems of the country,” he stated.

He spoke on the Nigerian paradox: “A country that specialises in exporting what it does not produce and importing what it produces; one of the world’s largest producers of crude oil that does not refine petroleum products but imports refined petroleum products; the world’s largest producer of cassava that does not produce starch or ethanol. Large tomato belt yet the world’s largest importer of tomato paste. A country that from my childhood I have heard had the potential of being a world power but every day we talk about potential. Today, we still talk about the potential of Nigeria and yet China, Indonesia, Japan, Korea, Vietnam, Brazil, all of these countries have turned the potential that they had into reality. What is the one thing that we need to do to break this barrier that faces us?”

On his experience: “Shortly after I came in and when we conducted investigations, I discovered that the Nigerian banking system was infested with the same corruption of the entire system in the country: that a number of bank chief executives had taken their banks and fleeced them of depositors’ money to buy property all over the world. And just like people do in ministries, in government agencies, or whenever they have the opportunity in oil companies, the banks were themselves a site for rent seeking.

“There was one chief executive officer that took away from her bank over N200 billion, and where was this money taken? Purchase of properties.

We recovered from one CEO 200 pieces of real estate in Dubai, real estate in Johannesburg, in the United States of America, apart from shares in over 100 companies and all of that was purchased with depositors’ money.

“For another CEO we got a judgment against that CEO for N142 billion stolen from the bank taken to buy shares and manipulate the shares of his own institution, and also transferred outside to purchase properties.

“Now, the first CEO we were able to convict, we recovered these assets and got a six months’ sentence and sorted it out. The second CEO, we finished our case established in Nigeria that we have a case in Nigeria, in the UK; two weeks before the closing statements were made the judge was miraculously promoted to the Federal Court of Appeal after three years of trial — at the very end of trial — because someone, a very popular religious leader with hundreds of thousands of supporters, carried him to the political authorities and the system that was supposed to protect depositors and handle criminals was used and manipulated to promote a judge so that he would not convict a thief. Now, this is an example of the kinds of things that happen in the country that prevent it from realising its full potential.

“Now, to my experience with the banking reforms, I observed the following: After the discovery of the things that happened in the banks, the most important thing was to take a critical decision that would pit us against powerful political and economic forces. We were dealing with chief executives that, in 2009, had become invincible. They were in the seat of power; they had economic power and had bought political protection. They were into political parties, they had financed elections of officers and they believed that nobody could touch them. And every time I said it was time to take action people said to me, ‘You can’t touch those people; you will be sacked’. Or, ‘You can’t touch these people; they will kill you’. And I said, you know what, we are going to take them on.

“And we took a decision to remove them, and, you know what, we removed them and nothing happened. We were going to prosecute them, put them in jail, and we put one of them in jail. We were going to recover these assets because the way the Central Bank operated in the past was such that these guys took all the money and the Central Bank said the banks have failed. The banks that we saved had N4.4 trillion in deposits. They had 8 to 10 million customers. But the government and the system had always betted on the side of the rich people. These 8 million customers — the old woman in Gboko or Yenagoa or Maiduguri who has struggled to save money for 40 to 50 years — and you wake up one day to say that the bank has failed and the money is gone. The man with his pension money in the bank, his children’s school fees, the medical bills, and you wake one day to say the bank has failed.

“When people say a bank failed, it is like seeing a man whose throat was slit and you say the man died; he didn’t die, he was killed. And those that murdered the banks have always walked free – they become senators and governors, they become captains of industry, they sit on the boards of banks and continue to be relevant in the system. Against millions of Nigerians who don’t have a voice.

“Nobody knows the number of people who have died as a result of failed banks. Because they were sick and could not pay the hospital bills, because their money was locked up in banks that had failed. Nobody knows the number of children whose parents could well afford to pay their school fees but they dropped out of schools because banks were mismanaged. Use these as examples of what you can do if you want to confront these vested interests and deal with them and protect the poor people of this country. But the banking industry is one sector in Nigeria; what is happening in other sectors?

“Take the oil industry: in 2009 this country paid N291 billion subsidy for petroleum products. By 2011, this number had jumped to N2.7 trillion. Did we start consuming 10 times the level of petrol? Did we have 10 times the number of cars? Did the population of Nigeria multiply 10 times? I do not believe these numbers. I screamed against these numbers and other people screamed and there have been investigations, and it was discovered that a lot of that money never went into fuel subsidy that was consumed by Nigerians. But people in this country had produced pieces of paper and gone to PPPRA and they stamped those papers claiming that they brought in petroleum products and actually paid them subsidy. And those pieces of paper said I brought 40,000 metric tonnes of petroleum product on so and so ship, and we discovered that that ship was nowhere near the shores of this country on the dates indicated.”

News

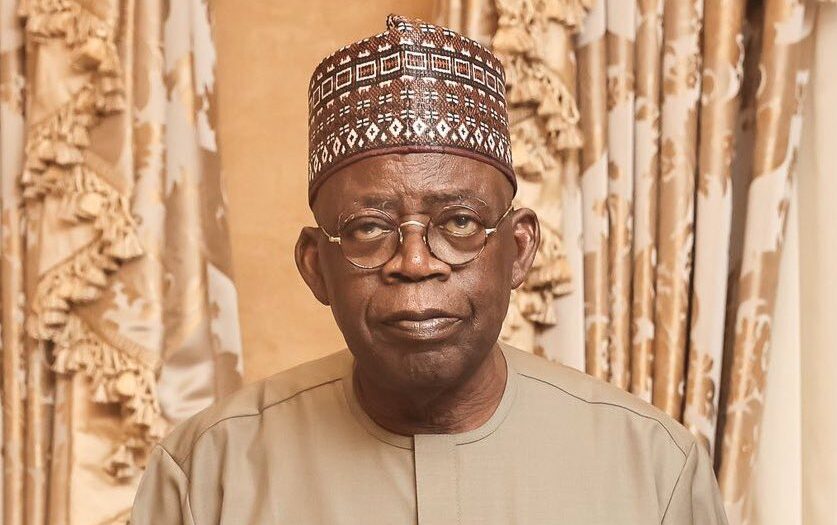

Tinubu Orders Security Chiefs To Restore Peace In Plateau, Benue, Borno

President Bola Tinubu has ordered a security outreach to the hotbeds of recent killings in Plateau, Benue and Borno States, to restore peace to areas wracked by mass killings and bomb attacks.

National Security Adviser, Nuhu Ribadu, disclosed this to State House correspondents after a four-hour security briefing with the President at the Aso Rock Villa, Abuja on Wednesday.

“We listened and we took instructions from him. We got new directives…to go meet with the political authorities there,” Ribadu told reporters, adding that Tinubu directed them to engage state-level authorities in the worst-hit regions.

Director-General, National Intelligence Agency, Mohammed Mohammed; Chief Defence Intelligence of the Nigerian Army, Gen. Emmanuel Undianeye; Director-General, Department of State Services, Oluwatosin Ajayi and Chief of Staff to the President, Femi Gbajabiamila, appeared for the briefing.

The Tide’s source reports that in Plateau State, inter-communal violence between predominantly Christian farmers and nomadic herders spiralled into gory slaughter when gunmen stormed Zikke village in Bassa Local Government early on April 14, killing at least 51 people and razing homes in a single night.

In Benue, at least 56 people were killed in Logo and Gbagir after twin assaults blamed on armed herders.

Meanwhile, in Borno State, eight passengers perished and scores were injured when an improvised explosive device ripped through a bus on the Damboa–Maiduguri highway on April 12.

Ribadu explained that after an extensive briefing, intelligence chiefs received fresh instructions to restore peace, security and stability across Nigeria.

“In particular, Tinubu had ordered immediate outreach to the political authorities in Plateau, Benue and Borno States, and the defence team had gone round those States to carry out his directives and report back.

“We gave him an update on what has been the case and what is going on, and even when he was out there, before coming back, he was constantly in touch. He was giving directives. He was following developments, and we, in charge of the security, got the opportunity today to come and brief him properly for hours. And it was exhaustive.

“We listened and we took instructions from him. We got new directives. The fact is, Mr. President is insisting and working so hard to ensure that we have peace, security and stability in our country. We gave him an update on what is going on, and we also assured him that work is ongoing and continues.

“We also carried out his instructions. We went round, the chiefs were all out where we had these incidents of insecurity in Plateau State, Benue State, even Borno, these particular three states, and we gave him feedback, because he directed us to go meet with the political authorities there,” the NSA explained.

Ribadu described Tinubu as “worried and concerned,” and said he directed that all security arms be deployed around the clock.

The government, he added, believes these steps have already produced measurable improvements, even if the situation is not yet 100 per cent safe and secure.

“He’s so worried and concerned, he insisted that enough is enough, and we are working and to ensure that we restore peace and security and all of us are there. The armed forces are there, the Civil Police, intelligence communities, they are there.

“They are working there 24 hours, and we feel that we have done enough to believe that we are on the right course, and we’ll be able to be on top of things,” Ribadu stated.

The NSA emphasised that combating insecurity was not solely a Federal Government responsibility.

He stated, “The issue of insecurity often is not just for the government. It involves the subunits. They are the ones who are directly with the people, especially if some of the challenges are more or less bordering on community problems.

“Not entirely everything is that, but of course it also plays a significant role. You need to work with the communities, the local governments, and the governors, especially the governors.

“The President will continue to direct that. We should be doing that, and that’s what we are able to. We are very happy and very satisfied with the instructions and directives given by Mr. President this evening.”

In Borno State, the NSA noted that while violence had surged in recent months, the insurgents refused to accept defeat.

He warned that most recent casualties there resulted from improvised explosive devices—”cowardly” IED attacks targeting civilians—and from opportunistic raids that follow any lull in fighting.

“We are getting the cooperation of the leadership at the state level, and everybody. It’s not 100 per cent…but we are going there.

“When you are having peace and you are beginning to get used to it, if one bad incident happens, you forget the periods that you enjoyed peacefully,” he added.

He paid tribute to the “many who do not sleep, who walk throughout, who do not go for any break or holiday”—the soldiers, police and intelligence officers whose sacrifices have created the fragile calm Nigerians now experience.

“They will continue to be there,” he said, adding, “Things have changed in this country…we are on the right track and we will not relent. We will not sit down; we will not stop until we are able to achieve results.”

News

FG Laments Low Patronage Of Made-In-Nigeria Products

A Federal Government agency – the National Agency for Science and Engineering Infrastructure, has decried the low patronage of Nigerian-made products by Nigerians.

The agency identified some challenges leading to the low patronage of the local products as affordability and public perception, among others.

Speaking during a stakeholders meeting organised by the agency in Akure, Ondo State capital, yesterday, the Deputy Director of Engineering at NASENI, Mr Joseph Alasoluyi, said Nigerians preferred buying foreign goods compared to local goods.

Alasoluyi, however disclosed that the agency had trained over 50 participants in the production of hand-made products, in a bid to ensure Nigeria-made products are patronised.

He explained that NASENI was set up to promote science, technology, and engineering as a foundation for Nigeria’s development and currently operates 12 institutes nationwide to achieve its objectives.

According to him, the aim of President Bola Tinubu, who is also the overall chairman of NASENI, was to ensure high production and patronage of “our local products thereby creating employment opportunities for many.”

He said, “The idea of this programme is to interface to ensure we produce products using our indigenous technology. This is what NASENI is out for, to ensure that homegrown technologies are encouraged.

“We are out there to ensure we integrate efforts to ensure that local technology is used to develop products within the resources we have.

“ The NASENI’s ‘3 Cs’ – Creation, Collaboration, and Commercialisation – that define NASENI’s strategic mandate: Creating innovations through research, Collaborating with partners to develop and refine products, and Commercialising these solutions to benefit the economy.

“Our achievements include the development of solar irrigation systems, CNG conversion centres, building machines capable of producing up to 1,000 blocks per hour, 10-inch tablets, locally made laptops, and electric tricycles (Keke Napep) set for market launch.”

In his remarks, the Deputy Vice Chancellor of the Federal University of Technology, Akure, Prof. Samuel Oluyamo, blamed the Federal Government for not properly funding research in the varsities, also noting that many research outputs were left halfway due to lack of funding and weak linkages between research institutions and industry.

Oluyamo also queried the Federal Government’s commitment to funding research and development, saying many academic innovations remained on the shelve due to a lack of support for commercialisation and poor infrastructure.

“Until we upscale research into mass production, technological growth will remain elusive. The government is not funding research in the universities enough. Thank God for TETfund that is trying in this regime. The major interest in beefing up research in universities and research institutions is really not there,” he said.

News

Nigeria Seeks Return To JP Morgan Bond Index

The Director-General of the Debt Management Office, Patience Oniha, has said that Nigeria is in advanced discussions with JP Morgan to re-enter the Government Bond Index and renew investors’ confidence.

Oniha disclosed this on Wednesday at a Nigerian Investors’ Forum on the sidelines of the World Bank and International Monetary Fund Spring Meetings in Washington, D.C.

The DMO boss explained that Nigeria has enjoyed favourable credit assessment among rating agencies in recent times on the back of the sweeping reforms initiated by the Central Bank of Nigeria.

Fitch Ratings recently upgraded the Long-Term Issuer Default Ratings of seven Nigerian banks and two bank holding companies to ‘B’ from ‘B-‘, noting that the outlooks are Stable.

The affected issuers are Access Bank Plc, Zenith Bank Plc, United Bank for Africa Plc, Guaranty Trust Bank Limited, Guaranty Trust Holding Company Plc, First HoldCo Plc, First Bank of Nigeria Ltd, Fidelity Bank Plc and Bank of Industry Limited.

The upgrades of the Long-Term IDRs of the banks followed the recent sovereign upgrade and reflect Fitch’s view that Nigeria’s sovereign credit profile has become less of a constraint on the issuers’ standalone creditworthiness, the rating agency said.

Fitch also upgraded Nigeria’s Long-Term IDRs to ‘B’ from ‘B-‘ on 11 April, a decision that reflected increased confidence in the government’s broad commitment to policy reforms implemented since its move to orthodox economic policies in June 2023, including exchange rate liberalisation, monetary policy tightening and steps to end deficit monetisation and remove fuel subsidies.

“These have improved policy coherence and credibility and reduced economic distortions and near-term risks to macroeconomic stability, enhancing resilience in the context of persistent domestic challenges and heightened external risks,” Fitch said.

Nigeria was removed from the JP Morgan index in 2015 ostensibly due to its deviation from orthodox monetary policies and influence of capital control in its management of foreign exchange.

Principally due to reduction in oil revenues at the time, Nigeria introduced currency restrictions to defend the naira after it failed to halt a dangerous slide with burning of dollar reserves. The bank had earlier warned Nigeria to restore liquidity to its currency market in a way that allowed foreign investors tracking the index to conduct transactions with minimal hurdles.

“Foreign investors who track the GBI-EM series continue to face challenges and uncertainty while transacting in the naira due to the lack of a fully functional two-way FX market and limited transparency,” the bank said in a 2015 note.

Nigeria was listed in JP Morgan’s emerging government bond index in October 2012, after the Central Bank removed a requirement that foreign investors hold government bonds for a minimum of one year before exiting.

The JP Morgan Government Bond Index reflects investor confidence and opens doors to billions of investment flows, making Nigeria’s proposed re-entry a positive signal to the market and investors.

Oniha explained that talks with JP Morgan were ongoing and had gained momentum in recent times due to the stability created by the FX market reforms.

“With all the reforms that have taken place, particularly around FX, we have started engaging JP Morgan again to get back into the index. We think we are eligible now,” the DMO DG said.

-

Business2 days ago

Keyamo Refutes Claims On Enugu Airport Concession

-

News1 day ago

Nigeria Seeks Return To JP Morgan Bond Index

-

News2 days ago

Okpebholo Denies Paying N6bn To Terrorist Group In Edo

-

Nation1 day ago

Over 26,000 Lagos Students Failed 2024 WASSCE -Commissioner

-

Niger Delta2 days ago

Engage Intellectually On Ijaw Struggle, Dep Gov Urges IYC

-

Business2 days ago

Include Adolescent Nutrition In National Policy – Nutritionist

-

Politics1 day ago

Politics1 day agoOborevwori, Okowa Dump PDP For APC

-

News2 days ago

Russia’s Biggest Strike On Kyiv Kills Nine