Oil & Energy

Oil Slips Below $107 As Supply Outlook Improves

Brent crude oil price was

below 107 dollars a barrel last Thursday, as expectations of more supply outweighed news of a large drop in U.S. crude stockpiles.

Huge volumes of crude from Iran and Libya have been blocked by political and civil disputes.

Worries that the extra supply will tip the oil market into surplus are outweighing signs of accelerating global economic growth and increasing fuel demand, analysts say.

“In the short term, Brent crude oil appears to be reducing,” said Carsten Fritsch, senior oil and commodities analyst at Commerzbank in Frankfurt.

“Oil prices have resisted a strong upward move in stock markets over the last month. That is a bearish sign.”

Brent crude for February delivery was down 48 cents at 106.65 dollars a barrel, after settling 74 cents higher on Wednesday. The contract was due to expire later on Thursday.

U.S. crude fell 20 cents to 93.97 dollars, after ending up 1.58 dollars in a third straight day of gains on Wednesday.

The February contract expires next Tuesday following a long U.S. holiday weekend.

Iran and world powers are due to begin talks in February on a deal to end a dispute over its nuclear programme.

The talks could include the easing of sanctions that are blocking up to 1.2 million barrels per day (bpd) of its oil exports.

Under a preliminary accord that goes into effect on January 20, Iran’s oil exports are to hold at current levels of about one million bpd.

Libyan oil supply could also rise sharply this year.

Libya’s southern El Sharara oilfield resumed production last week, increasing supply from the North African producer by more than 300,000 bpd.

On Wednesday, Libyan authorities were in negotiations with protesters threatening to restart a blockade of El Sharara, where protests cut output for two months last year.

U.S. crude oil found some support from data showing U.S. crude oil inventories fell 7.7 million barrels last week, compared with estimates of just 600,000 barrels.

It was the largest seven-week fall since records began.

The drop helped extend gains in U.S. oil.

Brent’s premium to U.S. crude continued to narrow, due to the expected start next week of the southern leg of the Keystone pipeline in the U.S.

The pipeline should help ease a supply glut at Cushing, Oklahoma, where the West Texas Intermediate crude contract is priced.

The spread reached a low of 12.42 dollars on Wednesday, the smallest gap in nearly two weeks.

Oil & Energy

FG, MEMAN Chart Ways To Safe Petroleum Products Delivery

The Federal Government and key Petroleum Products marketers have proposed new measures to help curb rising cases of road accidents involving petrol tankers.

This followed recent incidents of road accidents resulting in cremation of hundreds of lives and causing extensive damage to properties.

Speaking at the Discourse organised by Mejor Energy Marketers Association of Nigeria (MEMAN) in Lagos, Thursday, with the theme “Improving Safe Transportation of Petroleum Products”, the Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, noted with dismay the number of casualties the country recorded recently due to tanker accidents.

Lokpobiri stressed the need for an enhanced training for tanker drivers, installation of detection leak devices as well as other safety systems that can assist drivers.

He called on Marketers and Federal Road Safety Commission (FRSC) to strengthen collaboration with stakeholders, especially in the training of tanker drivers.

On his part, the Minister of State for Petroleum Resources (Gas), Ekperikpo Ekpo, reaffirmed government’s commitment to providing enabling environment to ensure safety of petroleum products transportation.

Ekpo, who was represented by Engr. Abel, said consideration should be given to more safety means of transporting products like the pipelines and railway line.

He stressed the need for better training for drivers and implementation of safety regulations within the industry.

Earlier, Chairman, MEMAN, Huub Stokman, said the Association has elaborate training manual for members truck drivers.

Stokman insisted that more training programmes and consistent adherence to safety measures would help to curb road accidents involving tanker drivers.

Also speaking, the National President, Nigerian Association of Raod Transport Owners (NARTO), Yusuf Lawal Othman, called for support.

Oil & Energy

Benue To Pioneer Gas Production From Coal – NGEP

The Chairman, National Gas Expansion Programme (NGEP), Prof. Mohammed Ibrahim, has said that the production of coal bed methane, an unconventional form of natural gas extracted from coal, is set to begin in Benue State.

Prof. Ibrahim staed this while addressing newsmen at the end of a joint meeting of the National and State gas expansion committees with Benue State Governor, Hyacinth Alia.

He said the Federal Government is committed to expanding gas availability in Nigeria for domestic use and mobility.

Ibrahim added that extracting gas from unconventional coal sources rather than traditional hydrocarbon reserves is a way to boost gas availability.

“Essentially there are four areas of implementation that the committee has identified. One is to pioneer the production of gas from what you call coal bed methane, which means that Benue is going to pioneer in the country the production of gas not from conventional hydrocarbon, but from non-conventional coal just so that the nation will have an alternative source to gas availability”, he said.

Also speaking, the Chairman, Benue State Gas Expansion Programme, Dr. Emmanuel Chenge, said the gas expansion initiative would contribute to the economic transformation of Benue State.

“The good news is that Benue is set to join the league of gas-producing states and if we are conversant with what being a member of the gas-producing state is, it shows that Benue State will start getting derivatives from that sector of the economy”, Dr Chenge stated.

The National Gas Expansion Programme (NGEP) was established to boost the exploration and utilisation of gas in Nigeria and make Nigeria a gas-based industrial nation by increasing the use of gas for transportation, cooking, and industrialization.

Oil & Energy

NNPC Debunks Explosion Claim In Warri Refinery

The Nigeria National Petroleum Company Limited (NNPCL) has said there was no explosion at the newly refurbished Warri Refining and Petrochemical Company (WRPC).

NNPCL’s Chief Corporate Communications Officer, Olufemi Soneye, made this known in a statement issued on Friday night.

Soneye said reports claiming that there was an explosion at the Warri refinery were false and should be ignored and disregarded by the public.

According to him, the refinery was undergoing routine maintenance.

His statement read, “NNPC Ltd. wishes to clarify that there was no explosion at the Warri Refining and Petrochemical Company (WRPC). Any reports suggesting otherwise are completely false.

“On January 25, 2025, operations at WRPC Area 1 were intentionally curtailed to carry out necessary intervention works on select equipment, including field instruments that were impacting sustainable and steady operations.

“These intervention works are essential to ensure the production of on-specification finished and intermediate products, particularly Automotive Gas Oil (AGO) and Kerosene (Kero).

“The routine maintenance is progressing as planned, and Area 1 will be back in operation within the next few days.

“Despite ongoing interventions, over the past 11 days, AGO loading has been maintained at an average of eight trucks per day, with a sufficient supply available to sustain ongoing truck load-out operations”.

Soneye added that the NNPCL was committed to ensuring an uninterrupted supply of petroleum products from the refinery.

He said the company “appreciates the patience and cooperation of all stakeholders as it completes these essential maintenance activities”.

-

Niger Delta5 days ago

Delta Approves N275bn For 76 Projects Execution

-

Editorial5 days ago

Editorial5 days agoSolid Minerals, Cesspit Of Corruption

-

Business5 days ago

Business5 days agoNigeria’s Non-Oil Exports Growth Rises 20.7% To $5.45bn In 2024

-

Politics5 days ago

Diri Renders Stewardship As Jonathan, Others Grace Anniversary Celebration

-

News5 days ago

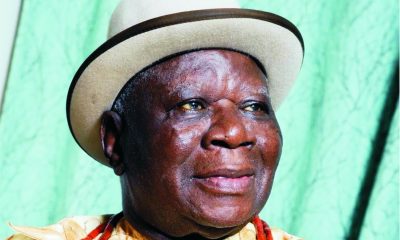

News5 days agoFubara Expresses Grief, Commiserates With Family Over Death Of Pa Edwin Clark

-

Business5 days ago

LCCI Urges FG To Reduce Inflation Through Improved Petrol Export

-

Niger Delta5 days ago

Niger Delta5 days agoUNICAL VC Institutes Scholarship To Reward Academic Excellence

-

Features5 days ago

A Farewell To Arms In Ogoni