Business

FRC Probes Banks Over Violation Of Lending Conditions To States

The Fiscal Responsibility Commission (FRC) has vowed to deal with banks that give loans to governments and agencies without following due process.

It also warned the state governments to reduce fiscal deficits, build revenue surplus and ensure effective resource allocation and prudent debt management.

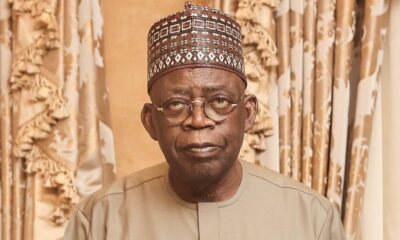

The Chairman, FRC, Victor Muruako, spoke during the two-day fiscal transparency and accountability sensitisation workshop in Lagos on Monday with the theme ‘Fiscal transparency and sustainable development at the sub-nationals’.

He said, “As for banks and other financial institutions that make themselves willing tools of fiscal carelessness by granting loans to some sub-national governments without regard to due process, the commission hereby reminds them that Section 45(2) in Part X of the Fiscal Responsibility Act 2007, which specifies conditions for borrowing by ‘any government in the federation or its agencies and corporations’, reads as follows: ‘Lending by banks and financial institutions in contravention of this part shall be unlawful.’

“In line with the foregoing, the commission hereby serves notice to defaulting banks and other financial institutions that the window of just using moral suasion is closing. Going forward, we intend to invoke the provisions of the law against this expressly defined unlawful act, wherever it rears its head.

“Where FRA, 2007 appears inadequate to compel, we shall aggressively invoke our collaborations with sister agencies such as the ICPC and EFCC.”

The chairman renewed the commission’s appeal to all states and local governments in the country to take up the challenge of achieving the five objectives in the fiscal sustainability plan upon which were predicated the Federal Government’s ‘bailout loans’ to states in 2016.

“We also wish to use this opportunity to discourage the bad habit of some subnational governments to make loans their first and last consideration for meeting revenue shortfalls rather than considering ways of harvesting their dormant potentials for internally generated revenue,” he said.

Muruako said the event was organised as part of a series of zonal sensitisation campaigns on transparency, accountability and prudence in public finance management.

Business

Expert Tasks Government On Civil Maritime Security Unit

Business

Bayelsa Recommits To Infrastructure, Sectoral Dev … Rakes In N227.185b From IGR

Business

NDYC Seeks NDDC Commercialisation … Uncompleted Projects Completion

-

Niger Delta1 day ago

D’Gov Emphasizes Agriculture In Industrialization … Tasks LG Health Authorities On Discipline

-

Editorial1 day ago

Editorial1 day agoIsrael-Gaza War: Sustaining The Ceasefire

-

Politics2 days ago

Politics2 days agoTinubu Sticking To ‘Snatch And Grab’ Agenda, Atiku Responds To Presidency

-

Politics1 day ago

Against Governors’ Resolution, Anyanwu Resumes Office At PDP Secretariat

-

News2 days ago

NGO Implants Free Pacemakers Into 22 Cardiac Patients In PH

-

Rivers1 day ago

100 Days: LG Boss Commissions Late Monarch’s Palace Fence, Solar Water Projects

-

Business1 day ago

FG Targets Power Sector Transition To Cost-Effective Tariffs

-

News2 days ago

Monarchs, MOSOP Hail Tinubu Over Ogoni Varsity Approval