Business

Cardoso Focuses On Monetary Policies To Save Naira

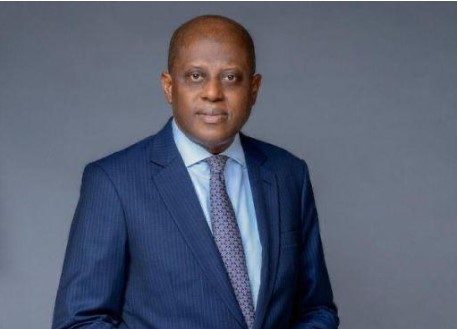

The new Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has disclosed that he and his team will focus solely on monetary policies to strengthen the Naira.

To achieve this, he explained, they will have to abandon some of the policies of the estwhile CBN, Godwin Emefiele, and his team that has warranted the rising inflation in the country.

Cardoso stated this during his screening by the National Assembly, and confirmation as the CBN Governor on Tuesday..

Responding to questions from the lawmakers, Cardoso said the CBN is faced with numerous challenges which the team had identified and would address them.

“We have identified issues of corporate governance, diminished institutional autonomy, discontinuity of orthodox policies and foreign currency issues.

“Addressing inflation and price stability is the function of the CBN. We will address the issue of foreign exchange unification. If there is a need for interest rate alignment, we will do it for economic growth”, he stated.

To manage the economic policy, Cardoso said size matters, adding that the CBN team had identified macroeconomic indices and will facilitate new ways to attain $1trillion GDP in eight years.

On inflation, Cardoso said each will be tackled based on their causes.

“If the inflation is on food, we should ramp up production of food. If inflation is on energy, we know the challenges of energy. If you are importing, automatically you are importing inflation”, he said.

On money supply, the apex bank Governor said the way money has gone up in Nigeria, “that, itself, is behind inflation. It is the problem. It is a big problem, but going forward, we will do everything possible to ensure that deficit financing does not bring problems to us.

“These are the assurances I can give you coming from outside because we will maintain a good working relationship to block the excesses we had in the past.

“I believe that the CBN under us will have no choice but to embrace a culture of compliance”, Cardoso said, assuring that they will abide by the CBN Act.

“We will not wait for oversight before we interact with the lawmakers. We will have zero tolerance to abuse of processes. We recognize the fact that we need to work closely with these chambers at the National Assembly to ensure compliance”, he said.

According to him, deficit financing and undue money glut are responsible for 50 per cent of the inflation.

Consequently, he told the Senate that there is a need to stabilise the naira to settle Nigeria’s outstanding debts, stating that the country is only spending money in printing currency rather than bringing in revenues.

According to him, the immediate thing to look out for is to address operational issues, which are the unsettled obligations of the CBN wealth of N4 billion or N7 billion.

He stated that Nigeria will not make progress if it is not able to handle that side of foreign exchange rate.

Cardoso also noted that foreign exchange rate is worrisome, hence Nigeria must have a stable exchange rate.

Also speaking, a Deputy Governor, Philip Ikeazor, said the present CBN is going to strengthen governance and focus on monetary policies and not fiscal policies, noting that the country must decide to support the physical majors of the CBN and ensure that exportation thrive.

“We will think outside the box, tackle inflation and the free flow of naira”, he said.

The Deputy Governors screened and confirmed are on the day were: Emem Usoro, Abdullahi Dattijo, Bala Bello and Philip Ikeazor.

Business

Abolish Multiple Taxation In Rivers, Group Urges Govt

Business

MDAs, Presidency Spend N1.9bn On Trips, Trainings In France

Business

NCDMB, ARPHL, Others Partner On Refinery Project

-

Politics2 days ago

Court Adjourns Natasha’s Suit Against Senate To March 25

-

News2 days ago

IGP Reaffirms Ban On Public Parade Of Suspects

-

Business2 days ago

Firm’s Retirees Seek Special Consideration In N758bn Pension Fund

-

Rivers2 days ago

IWD Celebration: Royal Queen Tasks Women On Family Priority

-

Business2 days ago

Reps Tasks NESEREA, NOSDRA On Safe Waste Disposal Enforcement

-

Politics2 days ago

Women Group Seeks Greater Inclusion In Decision Making Process

-

News2 days ago

Reps urge CBN to suspend increase in ATM withdrawal charges

-

Business2 days ago

Airline Denies Talk With FG Over Nigeria Air Revival